Why fear, risk, and speculation belong together — and how AI is teaching us that lesson right now

Wall Street is talking about cockroaches again. Not just the real ones that come with city life, but the metaphor — the symbol of market excess.

Technology has never been so powerful, so promising — and so dangerously concentrated. In just three years, artificial intelligence has triggered a wave of euphoria that even Silicon Valley rarely sees.

Since the launch of ChatGPT, over 90% of U.S. GDP growth has come from AI investments. According to Harvard economist Jason Furman, this year the American economy would be flat without this bet on the future.

Forty percent of the entire S&P 500 is tied to just ten companies — Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, Tesla, AMD, Broadcom, Palantir. That’s not diversification. That’s monoculture. And every monoculture has its pests.

The only question is: When? Not if.

Or will this time be different? Have we finally found the tool to unlock the kind of efficiency leaps that revolutionized entire industries with Kaizen and later Lean Management in the 1970s?

When you see one cockroach…

Wall Street has a cynical saying: “When you see one cockroach, there are probably more.”

It captures the nature of financial bubbles. The first visible problem is never the last. It’s just the moment the light switch is thrown. The AI economy is full of such shadows.

OpenAI is promising Oracle $300 billion for data centers that haven’t even been built. Nvidia is investing $100 billion in OpenAI — money that flows right back into Nvidia chips. It looks like growth, sounds like the future — but it’s really a cycle of balance sheet pressure and storytelling.

As long as belief holds, the system works. But when the first cockroaches is visible in the light — a collapsed deal, massive layoffs, a disappointing ROI report — the narrative shifts. And markets are nothing more than collective stories about the future. When the story breaks, so does the market price.

Narratives are the oxygen of capitalism

Scott Galloway calls it “story fragility”: valuations today depend less on balance sheets than on stories. That’s especially true for AI. (Source)

The story goes: “AI will transform work.” But the data says: the share of work-related ChatGPT prompts has dropped from 47% (2022) to 27% (2025). AI isn’t changing our work — it’s changing our daily lives, our leisure, communication, perception.

Can companies like ServiceNow, Microsoft, or Neura Robotics actually turn expected efficiency gains into real productivity? Or will the productivity story evaporate before it delivers?

When trust fades, all that remains is a system telling itself it’s growing — because it must.

That’s where the cockroaches show up: in the gap between narrative and reality.

Efficiency is no substitute for trust

Maybe the next crash won’t come from falling stock prices, but from rising unemployment. If AI truly delivers the promised efficiency, it will hit wages first — not prices.

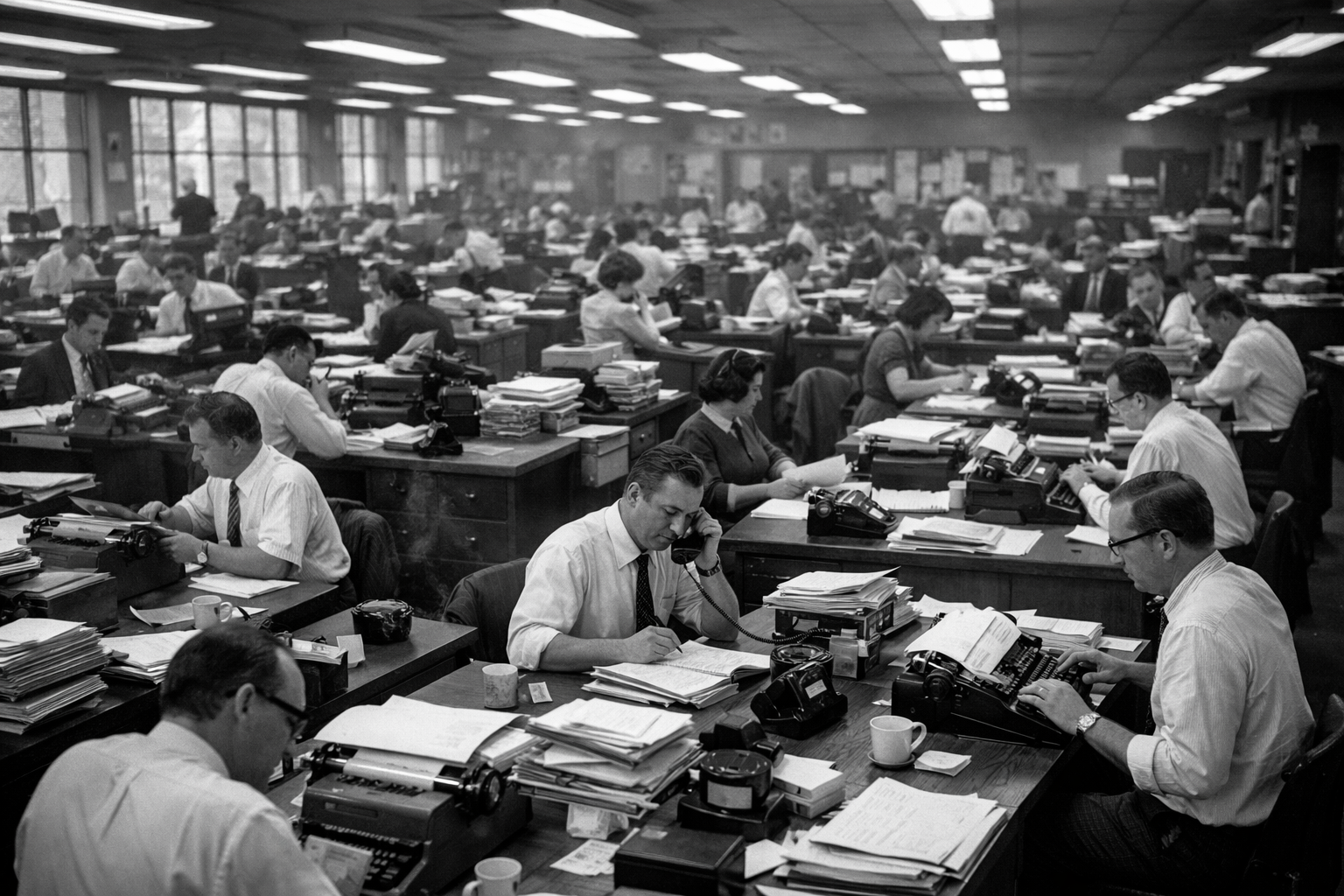

Ten million white-collar jobs could vanish in the coming years — while corporate profits remain stable or even rise. A paradox: progress works, but it destabilizes the system that supports it.

In an economy that distributes wealth through employment, productivity quickly becomes a threat. One less job isn’t a crisis — ten million fewer is a societal shockwave.

Will it be different this time?

That’s the real question: Is AI the kind of progress that changes everything — or just the latest version of the old cockroach logic?

Andrew Ross Sorkin offers a counterpoint to Galloway’s doom narrative in the New York Times. He reminds us that speculation isn’t a moral failure — it’s the DNA of American capitalism. (Source)

“Speculation isn’t a bug in America’s economic code — it’s part of the engine.”

Without speculation, there would be no Tesla, no SpaceX, no OpenAI, no COVID vaccines, no railroads, no internet. Every industrial revolution begins with bets that seem irrational — until they work.

Sorkin’s thesis: speculation is belief plus risk. It’s not gambling, but the courage to invest capital in an uncertain future. Without it, there’s no innovation. No risk, no momentum.

Speculation isn’t a vice — it’s energy

Sorkin doesn’t see 1929 as the end of greed, but the beginning of regulation. The crash was the price of missing structures. But instead of banning risk, the U.S. built institutions: the SEC, the FDIC, margin rules, disclosure requirements.

We didn’t eliminate speculation — we tamed it with rules. Compliance became the civilization of risk. That was the launchpad of the American century: risk as a manageable resource. Speculation was moved from vice to productivity because it was institutionalized.

The lesson from 1929 isn’t: don’t speculate.

It’s: speculate responsibly.

In the last 20 years, this gave rise to the VC industry — a whole sector that professionalized betting on the future, distributing, scaling, and trading risk.

The AI era between doom and drive

With that, we stand between two poles today: on one side, the doomsayers who warn that the AI hype is a house of cards, built on ten overheated companies and a society that traded political reason for rising stock prices.

On the other side, the progressives who say: no bet, no progress. No excess, no movement.

Both are right. Because speculation isn’t a mistake — it’s energy. But energy without structure becomes explosion.

The blind spot of the present

A pattern repeats — one that’s shaped America for 150 years: technology accelerates, capital concentrates, society loses balance. What’s missing is governance.

After the dot-com crash, governance emerged over the next decade in the form of cloud stacks and platform economies — open standards at the interfaces of giant empires that collaborate and grow the pie.

The state watched but didn’t tame the monopolists. The U.S. didn’t steer the economy — the geopolitical advantages of platform dominance were too great. In Germany and Europe, we overregulated.

The AI economy has no modern equivalents to the SEC or FDIC. The U.S. watches and declares a system rivalry with China. There’s no clear rulebook for data, compute, or energy access. No reliable accounting for models whose assets are probabilities.

We invest blindly — not out of naivety, but because progress outruns control. That was true in 1929, in 2000. Then and now, the same three forces drive us: belief, greed, speed.

But after 1929 came financial order. After 2000, it took ten years for platform economics and cloud models to bring structure. After this AI wave, we’ll need it again: new structures, new players, a new order.

Europe and the fear of its own cockroaches

Is this really Europe’s chance? Probably not. We think we’re smarter because we spot the cockroaches earlier. In truth, we just dream of them sooner — out of fear that they might just appear.

We mistake caution for reason and lose the courage to think big. Our researchers, engineers, and physicists are world-class. But what we lack isn’t talent — it’s hunger. The will to bet again. The courage to dent the universe, not just make the SMEs bit more efficient.

We regulate before we risk. And that’s how we exclude ourselves from progress. Without capital, without bets, without the willingness to fail, innovation remains theory. That’s why Europe’s best founders still need U.S. money — because speculation is a virtue there, and a danger here.

So what should we do with cockroaches?

Scott Galloway wants to be right and warns: “America’s bet on AI is now a bet without a hedge.”

Andrew Ross Sorkin reminds us: “Speculation built America.”

Both are true.

Progress always emerges at the edge of risk and madness. The cockroaches always come — they’re part of our system because they’re part of us. They embody our fear of loss, of losing control, of losing relevance.

They don’t appear because it’s over — but because we finally turn on the light. The light of collective attention. And those who don’t panic, but understand what they see, build the next order. The next industry.

Maybe that’s Europe’s chance: to stop running from the shadows and start interpreting them. To become a continent that believes in itself again — and in the power to shape risk, not fear it.